Boyar Value Group Blog

Read the latest news & insights from the team at Boyar Value Group.

FILTER:

The Boyar Value Group’s 1st Quarter Letter 2020

The Boyar Value Group just released our latest quarterly letter to clients.

The 9/11 And Financial Crisis Playbook For Investing Amid The Coronavirus

Jonathan Boyar discusses lessons we learned from investing through 9/11 and 2008-2009 and how they can be applied to the current situation.

Jonathan Boyar On Finding Value With Markets At/Or Approaching All-Time Highs

Jonathan Boyar was a guest on Yahoo Finance discussing where the Boyar Value Group is finding value with markets at or approaching all-time highs.

Jonathan Boyar On Private Market Value, Spinoffs And More With Tobias On The Acquirers Podcast

On the latest Acquirer’s Multiple podcast with Tobias Carlisle, Jonathan Boyar discussed:

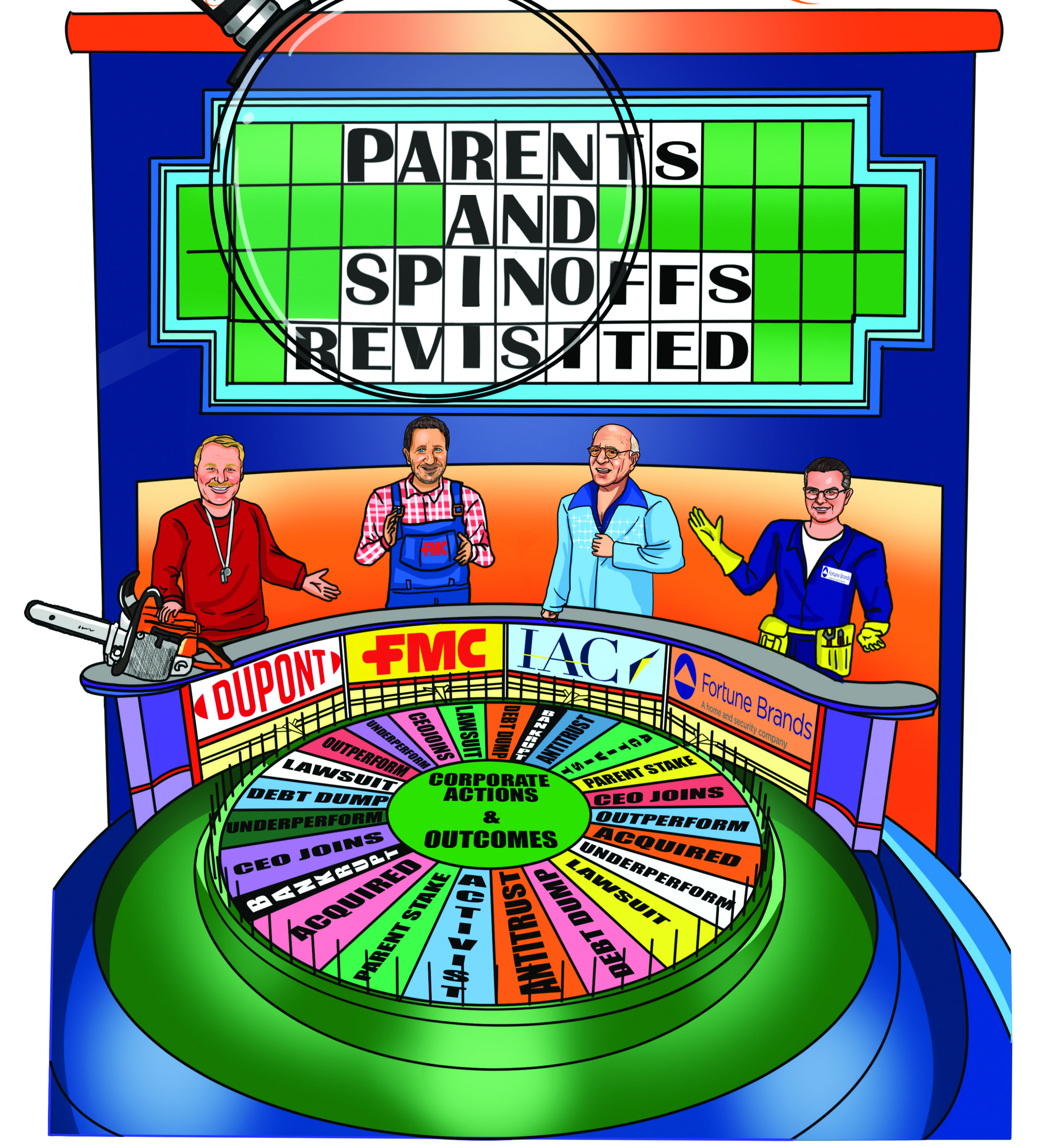

Spinoffs Have Dramatically Underperformed. Here's How To Profit From Them

Historically spinoffs have been a dependable source of market beating investment ideas. Conventional wisdom says that spun-out entities have thrived when given the freedom to..

Spinoffs Have Dramatically Underperformed. Here’s How To Profit From Them

Historically spinoffs have been a dependable source of market beating investment ideas. Conventional wisdom says that spun-out entities have thrived when given the freedom to..

The Forgotten Forty: Stocks That Could Outperform In The Year Ahead

On a recent CNBC appearance, Jonathan Boyar identifies a few stocks that we believe could outperform in the year ahead.

The Boyar Value Group’s 4th Quarter 2019 Client Letter

Boyar Research recently released our latest quarterly letter to clients.

Stock Ideas For 2020: Interview with Jonathan Boyar and Frank Curzio

Jonathan Boyar was recently interviewed by Frank Curzio on his Wall Street Unplugged podcast where he discusses Boyar Research’s investment philosophy, two stocks for 2020 and the..

The Boyar Value Group’s 3rd Quarter 2019 Client Letter

Boyar Research recently released our latest quarterly letter to clients.