Boyar Value Group Blog

Read the latest news & insights from the team at Boyar Value Group.

FILTER:

How To Navigate The Current Stock Market Volatility Revisited

Amid the daily parade of frightening headlines, it’s anyone’s guess what will make stocks recover from here. But through all the uncertainty, I am keeping in mind Warren Buffett’s..

How Investors Should Navigate The Recent Volatility

In my opinion, the worst thing investors can do is sell during a panic. Since 2001 the S&P 500 has increased by ~7.5% per year, yet the average investor has received a return of..

Has Dotdash Meredith Found Hidden Value In Underappreciated Brands?

In 2021, an unlikely suitor bought Meredith’s magazines: digital publisher Dotdash, which owns sites including The Balance, The Spruce and Investopedia, and is itself owned by..

Beware Of False Bargains

One of Warren Buffett’s most famous quotes (echoing Benjamin Graham) is “Price is what you pay; value is what you get.” For most people it’s difficult to separate a company’s..

Unlocking Value In The Cannabis Market Jim Hagedorn Has A Strategy For Navigating Legalization

Value investors rarely get a chance to participate in fast-growing trends. The momentum behind areas poised for rapid growth—say, artificial intelligence, electric cars or battery..

Positioning Your Portfolio For A Debt Ceiling Debacle

As the talking heads on TV debate the chances of the U.S. raising the debt ceiling past its current cap of $28.4 trillion, many, including Treasury Secretary Janet Yellen and JP..

IAC CEO Joey Levin On The Company's $1 Billion Bet On MGM

Barry Diller’s IAC has produced a long string of success stories, in large part because of patient, strategic capital allocation. The company has built a powerful niche for itself..

Value Does Not Have To Mean Cheap

It’s a scenario value investors dream about: a growing company whose shares are selling at a statistically cheap price. Of course, these types of stocks can be hard to find—and..

A Brave Stock To Buy Before America Reopens

A discerning eye is the key to thriving in turbulent markets

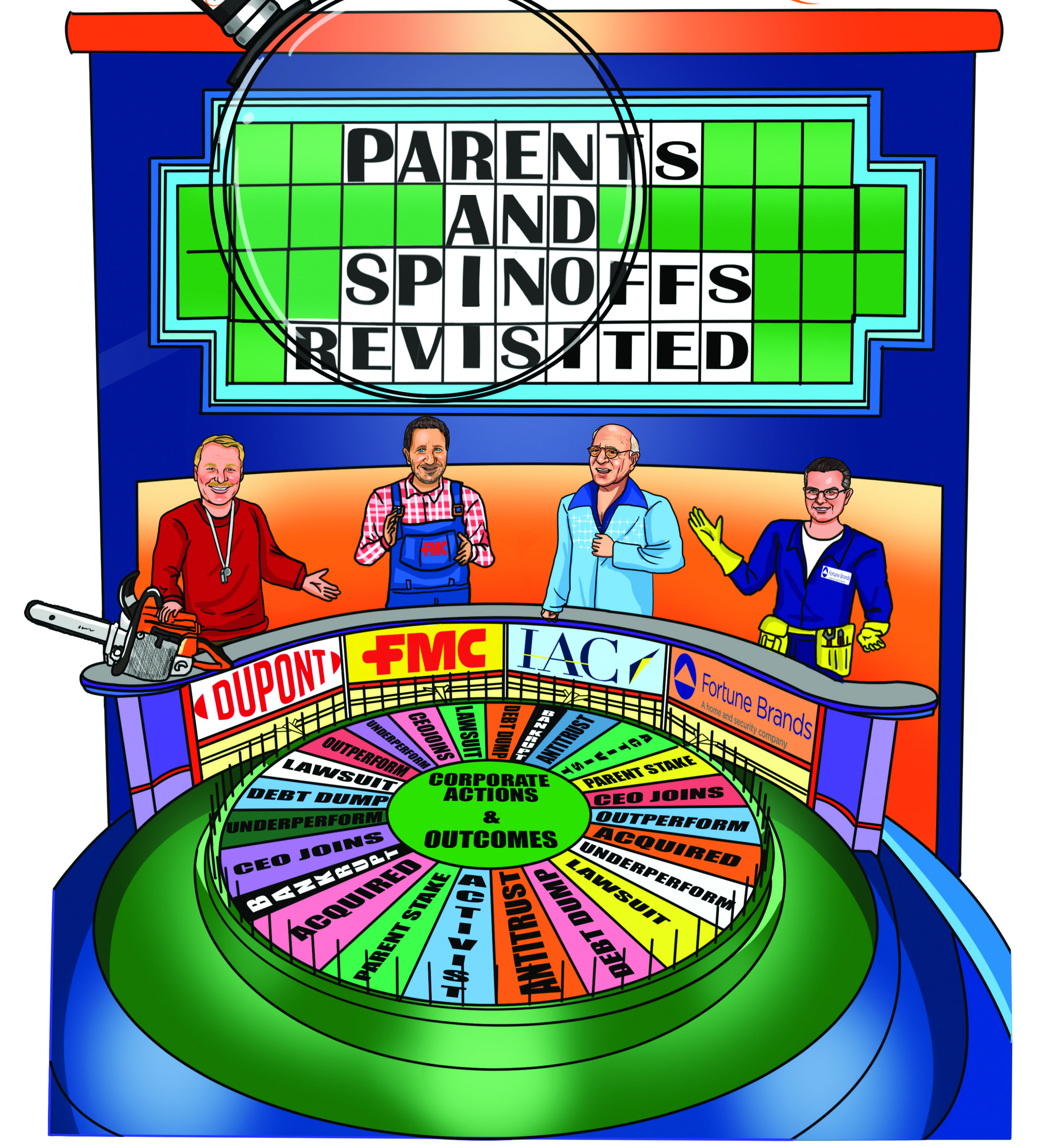

Spinoffs Have Dramatically Underperformed. Here's How To Profit From Them

Historically spinoffs have been a dependable source of market beating investment ideas. Conventional wisdom says that spun-out entities have thrived when given the freedom to..

Open Letter to James Dolan Outlining Ways to Unlock Shareholder Value

Sometimes I think of you as the Rodney Dangerfield of investing—investors just don’t give you the respect you deserve. They’ve gone so far as to assign a “Dolan discount” to..

Is CVS A Value Trap Or A Fallen Angel Ready To Rise Again?

We love searching for value among former Wall Street darlings that are now unwanted and unloved. In the same way herd behavior can push a company’s share price to insane heights,..